Everyday Items or Extraordinary Heirlooms: Valuing and Inventorying Cherished Property

Some items are simply irreplaceable. Whether a rare work of art, a first-edition book or a keepsake from a loved one, some possessions can never be replaced if lost. When the unexpected strikes, such as a disaster like a fire, structure collapse or flood, cherished items can be destroyed along with your other belongings.

As if the loss of such items is not enough of a disappointment, reconciling the value of these kind of special possessions with your insurance provider can prove difficult. But there are steps you can take to further protect your investments and rare items in the event of an unforeseen tragedy. We look at how to protect your property and properly insure your unique assets.

Inventory Your Unique Items

One of the most critical steps you can take to prepare for the potential need to file a claim for rare or unique possessions is to maintain an accurate inventory of any such items. Having an inventoried list helps you keep an updated and organized tally of your possessions, but also serves as a record of what you own. As AAA notes, this is important not only so that you can maintain an up-to-date and organized record of any such items in case of a loss, but may also be a requirement for your insurance company.

One of the most critical steps you can take to prepare for the potential need to file a claim for rare or unique possessions is to maintain an accurate inventory of any such items. Having an inventoried list helps you keep an updated and organized tally of your possessions, but also serves as a record of what you own. As AAA notes, this is important not only so that you can maintain an up-to-date and organized record of any such items in case of a loss, but may also be a requirement for your insurance company.

“Putting together an inventory is a good way to know exactly what you have and what it’s worth,” said Steve Vanuga, principal of Adjusters International/Basloe, Levin & Cuccaro. “This is beneficial for your own record keeping, of course, but can also be critical if you ever need to file a damage or loss claim with your insurance company.”

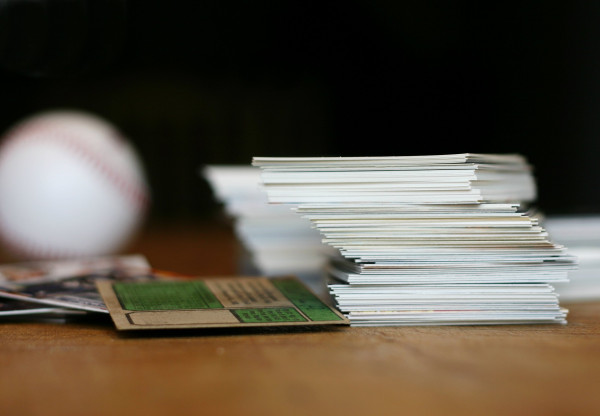

When compiling an inventory, it helps to be as detailed as possible and support your listing with specific details, documents and receipts whenever possible. For example, there can be a dramatic value difference between a near-mint Mickey Mantle rookie baseball card and one in poor condition, so simply noting that you possess one may not provide a sufficient amount of detail to support your claim. Receipts of purchase can also support possession and even document the value of items. But there’s one way to definitively determine your belongings’ worth.

Have Your Items Appraised

Appraisers are professionals who work to assign value to a range of items. Given fluctuations in the market – item availability, rarity, demand and scarcity, for instance – these experts are the most well-versed in determining what a one-of-a-kind or unique item could be worth.

As many rare works and limited-edition items increase in value as time goes on, the value for something today can differ dramatically in a relatively short time period. Having any rare or unique items you own appraised on a semi-regular basis can not only help you better understand the worth of the things you own – and how that valuation has changed – but provide a fair and accurate value for these possessions in case you ever need to make a property damage or loss insurance claim.

It is important to keep in mind that different types of items should be appraised by a person who is a specialist in that field. For example, you would not take a cherished pocket watch to be valued by a rare manuscript dealer. Having your unique items evaluated on a semi-regular basis – perhaps once every few years – allows you to have up-to-date records on the dollar values for these belongings, verified and vetted by a third party.

Get the Right Coverage

Another critical step is making sure that your homeowner’s insurance is sufficient to cover your unique and rare possessions. Some items that fall into this category require specialized policies that offer additional insurance coverage for these specialized items. This is especially true for antiques and other items that could never be truly replaced, and some special rules apply for such belongings.

As the Insurance Information Institute notes, most insurers require a specific policy rider to cover antiques, high-value jewelry and other types of unique items. As part of this coverage, you will also generally be expected to maintain an up-to-date inventory, get items professionally appraised and notify your insurer of any new additions or sales of items to ensure an accurate accounting.

You will also want to make sure to fully understand the nature of your coverage on these items. Some policies may cover repair or restoration for damaged items, while others may provide for replacement with an equivalent modern version or even a reproduction, which can be worth significantly less than the original. Your policy may also outline different loss circumstances, such as fire or theft, and the recourse for each. Make sure that your insurance provides the right coverage for your items so that in the case of a claim, you can rest assured that your most valuable assets are protected.

Find Assistance for Your Claim

If you have suffered a loss at your home, whether due to a fire, winter storms or even vandalism, the team at Adjusters International/Basloe, Levin & Cuccaro can help. With offices across New York, Maine and Pennsylvania, our experts are well-versed in property loss claims involving rare and unique items and can help you through the process with your insurance company. Contact the office nearest you today and discuss your case with our independent public adjusters.